Choosing the right solar installer to finance your solar panels is a crucial decision. It can significantly impact your long-term investment in solar energy.

Understanding the various solar financing options is key. These options, including leases, loans, and power purchase agreements (PPAs), can affect the overall cost of your solar installation.

This guide aims to help you navigate this process. It will provide actionable advice on assessing the credibility of solar installers, comparing financing terms, and understanding the potential benefits of your solar investment.

By the end, you’ll be equipped to make an informed decision that aligns with your financial needs and energy goals.

Understanding Solar Financing Options

Solar financing can seem complex, but it’s essential to explore. Different options cater to various financial situations. Knowing your options ensures a plan tailored to your needs.

Here’s a quick overview:

- Leases: Pay a monthly fee to use the solar system. The installer retains ownership.

- Loans: Borrow funds to purchase the system outright. You own the panels and pay back over time.

- PPAs (Power Purchase Agreements): Purchase solar power at a set rate. The installer owns and maintains the system.

Each option has distinct benefits. Choose what suits your financial situation and energy goals best.

Evaluating Solar Installer Credentials

Choosing the right solar installer involves more than price. Verify their licenses to ensure compliance with local regulations. Proper licensing indicates a professional approach and adherence to standards.

Certifications reveal expertise and commitment to quality. Check for industry-standard certifications. They reflect an installer’s capability to deliver reliable services and installations.

Insurance offers protection against unforeseen issues. Confirm that the installer carries valid insurance. This coverage shields you from potential liabilities during and after installation.

Comparing Solar Financing Terms

Understanding financing terms is crucial for cost-effective solar investment. Start by examining interest rates. Lower rates can save significant amounts over time.

Loan terms, such as length and repayment schedule, affect your monthly payments. Choose terms that fit your financial situation and energy savings goals.

Watch for hidden fees, which can inflate costs. Request a breakdown of all charges. Transparency in fees ensures no surprises in your financing agreement.

Assessing Solar Equipment Quality

The quality of solar panels plays a major role in system performance. Look for panels with high efficiency and durability.

Inverters are vital components that convert solar energy for home use. Opt for inverters known for reliability and long lifespan.

Warranties offer protection for your investment. Ensure both panels and inverters come with substantial warranties, covering at least 20 years.

Checking Reviews and References

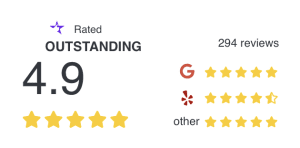

Customer reviews provide insights into the installer’s reliability and service quality. They’re a window into real user experiences.

References from past customers can confirm the installer’s track record. Reach out and ask specific questions about performance and service.

Online testimonials and ratings add credibility. Seek installers with consistently high ratings and positive feedback.

Analyzing the Solar Installer’s Support and Maintenance Services

Effective post-installation services are crucial for the longevity of your solar system. A reliable installer will provide ongoing support.

Consider the customer service quality offered by the installer. Prompt response times indicate a commitment to customer satisfaction.

Maintenance services ensure the system’s optimal performance. Regular check-ups help maximize energy production and system efficiency.

Considering Environmental Impact and Energy Savings

Choosing solar energy means reducing your carbon footprint. It’s an investment in a cleaner environment and sustainable future.

Solar panels offer long-term energy savings. They can significantly lower or even eliminate monthly electricity bills, maximizing financial returns.

Consider how the potential energy savings align with your environmental goals. A well-financed solar project supports both financial and ecological objectives.

Conclusion: Making Your Solar Financing Decision

Selecting the right solar installer with financing options is crucial. It ensures your investment in solar energy meets both financial and energy objectives.

Consider all factors such as financing terms, equipment quality, and installer credentials. A thoughtful choice will yield both immediate savings and long-term benefits.

Want to learn more about Synergy Power? Fill out this short form and we will setup a meeting to discuss your project!